Financial Wellness

at MCC

- About Us

- Success Scholars Program

- Managing Money

- Coaching Sessions

- Events

- Workshops

- Upcoming Workshops

- Previous Workshops

- Library Guide

- Financial Assistance Resources

- Paying for School

- Contact Us

Workshops

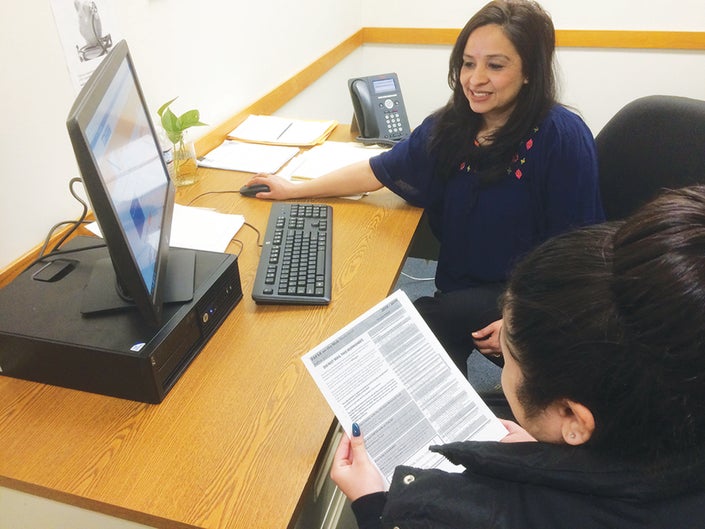

The Financial Wellness Coach conducts several in-class workshops throughout the semester.

The goal of these workshops is to introduce students to the tools and resources available

at the college and the community to achieve financial stability. Real-life scenarios

are discussed in these workshops to highlight the importance of learning personal

finance topics such as budgeting, credit, savings, paying for school, etc.

Upcoming/current Workshop(s):

Application Assistance for MCC Foundation Scholarships

Zoom Link: https://middlesex-mass-edu.zoom.us/s/92753468650

Virtual Open Labs (zoom only) at 1pm.

- Tuesday, February 29th

- Tuesday, March 12th

- Friday, March 15th

- Monday, March 25th

- Monday, April 1st

- Tuesday, April 9th

- Wednesday, April 17th

- Friday, April 26th

- Tuesday, March 5th

- Thursday, March 7th

* Remember the MCC Foundation Scholarships Deadline is Friday, April 26, 2024.

Past Workshop(s):

FAFSA Workshop

Thursday, April 27, 2023

2:00PM - 4:00PM

Click on zoom link to join or come in person:

Cowan Center, Room 201

Zoom link: https://middlesex-mass-edu.zoom.us/j/93395653279